Compound Interest Calculator

About the Compound Interest Calculator

Our Calculator helps you see how your money can grow when interest is added to both your initial principal and the interest already earned. Just enter your principal amount, annual interest rate, compounding frequency (daily, monthly, quarterly, yearly), time period, and optional monthly or yearly contributions to get instant results.

What this Compound Interest Calculator shows

Future value of your investment

Total contributions vs. total interest earned

Growth over time with different compounding frequencies

Impact of increasing contributions or extending time

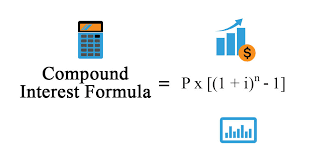

How it works (the formula)

The standard compound interest formula (without periodic contributions) is:

A = P × (1 + r/n)^(n×t)

Where:

A = future amount

P = principal (starting amount)

r = annual interest rate (decimal)

n = number of compounding periods per year

t = time in years

When you add regular contributions, the Compound Interest Calculator factors those in to show a more realistic growth curve.

Example

Invest ₹50,000 at 8% annual interest, compounded monthly, for 10 years with ₹2,000 monthly contributions. The Compound Interest Calculator will estimate the final amount, total invested, and total interest earned—clearly showing how compounding + consistent contributions accelerate growth.

Compound Interest Calculator – Global Edition

Calculate how your investments grow with compound interest

Year-by-Year Growth

| Year | Principal | Interest | Total Amount |

|---|

Why use this tool?

Compare compounding options (monthly vs. yearly)

Plan SIPs or recurring deposits with clarity

Set realistic long-term savings/investment goals

Visualize the power of time + consistency

Tips for best results

Increase contribution amounts gradually each year if possible

Start early—time in the market beats timing the market

Revisit assumptions (rate, frequency, tenure) annually

Use our Compound Interest Calculator to make smarter investment decisions and watch your money grow, one compounding period at a time.

Understanding Compound Interest and Its Importance in Financial Growth

Compound interest is one of the most powerful concepts in personal finance and investing. Unlike simple interest, which is calculated only on the initial principal amount, compound interest allows your money to grow not just on the principal but also on the accumulated interest over time. This effect is often described as “interest on interest,” and it can significantly increase the value of your savings and investments if you remain consistent and patient.

For example, if you invest ₹10,000 at an annual interest rate of 10%, compounded yearly, after 10 years your investment won’t just be ₹20,000 as it would with simple interest. Instead, it will grow to more than ₹25,000 because each year’s interest is added to the balance, and the following year’s interest is calculated on that larger balance. This snowball effect is what makes compound interest so valuable for long-term wealth building.

Why Compound Interest Matters for Your Finances

Wealth Creation Over Time – Even small amounts invested regularly can grow into large sums over decades.

Encourages Early Investing – The earlier you start, the more time your money has to multiply.

Helps Beat Inflation – Investments with compound growth often outpace inflation, preserving your purchasing power.

Goal-Based Planning – Whether it’s retirement, a child’s education, or buying a home, compound interest helps you achieve long-term goals.

Real-Life Applications of Compound Interest

Savings Accounts: Banks use compound interest to grow your deposits.

Fixed Deposits and Recurring Deposits: A safe option for conservative investors.

Mutual Funds & SIPs: Systematic Investment Plans allow you to take full advantage of compounding.

Retirement Accounts: Pension schemes and retirement plans depend heavily on compounding to grow funds over decades.

How to Use the Compound Interest Calculator Effectively

Enter your principal investment – the starting amount you plan to invest.

Choose the rate of interest – depending on the financial product (bank deposit, mutual fund, or loan).

Select the compounding frequency – annually, quarterly, or monthly.

Set the investment duration – the number of years or months.

With these details, the calculator instantly shows how much your investment will grow over time. This makes it easier to compare different investment options and choose the one that fits your financial goals.

Start Your Investment Journey Today

Calculators are useful, but the real benefits come when you take action. By starting early and investing regularly, you can unlock the full potential of compounding. Whether you are saving for retirement, education, or wealth creation, the right financial product can make a big difference.

Check out this recommended investment option that offers attractive compounding benefits and can help you build wealth systematically.